A Conversation with Gemini

What is the economic reality of blockchain write only databases or ledgers.

Show thinking

Okay, let’s break down the economic reality of blockchain-based databases or ledgers, focusing on their characteristic as largely “append-only” (data is added, but extremely difficult to modify or delete once confirmed).

The economic reality is complex and highly dependent on the specific use case, the type of blockchain (public vs. private/consortium), and comparison to traditional database solutions. Here’s a breakdown:

- 1. High Costs (Often Higher than Traditional Databases):

- Development & Implementation: Building and integrating blockchain solutions requires specialized expertise, which is often expensive and less common than traditional database skills. Setting up nodes, smart contracts, and ensuring security is complex.

- Transaction Costs (Gas Fees): Particularly on public blockchains (like Ethereum), every transaction (writing data) requires a fee paid to network validators/miners. These fees can fluctuate wildly and become prohibitively expensive, especially for high-volume applications.

- Energy Consumption: Proof-of-Work (PoW) blockchains (like Bitcoin, though Ethereum has moved away) are notoriously energy-intensive, leading to high operational costs and environmental concerns. Proof-of-Stake (PoS) and other consensus mechanisms are more efficient but still require infrastructure and incentives.

- Storage Costs: Every node in the network typically stores a copy (or at least the headers) of the entire ledger. As the ledger grows, storage requirements increase across the network, although solutions like sharding aim to mitigate this.

- Scalability Limitations & Costs: Many blockchains face limitations in transaction throughput (transactions per second). Scaling solutions (like Layer 2 networks) add complexity and potential additional costs or trust assumptions.

- 2. Economic Benefits (The Value Proposition – Where Costs Might Be Justified):

- Trust & Transparency: In scenarios involving multiple parties who don’t fully trust each other (e.g., supply chain, consortiums, international trade), the shared, immutable, and transparent nature of the ledger can reduce the need for costly intermediaries, audits, and reconciliation processes. This disintermediation is a key potential economic benefit.

- Immutability & Security: The high cost and difficulty of altering past records provide strong data integrity. This is valuable for applications where tamper-proofing is critical (e.g., land registries, intellectual property, voting systems – though practical implementations vary). This reduces risks associated with data manipulation or fraud.

- Automation via Smart Contracts: Smart contracts can automate agreements and processes based on ledger data (e.g., automatic payment release upon verified delivery). This can reduce administrative overhead and speed up execution, potentially lowering costs.

- Resilience & Availability (Decentralization): A truly decentralized network has no single point of failure, potentially offering higher uptime and censorship resistance compared to centralized databases (though many “enterprise blockchains” are not fully decentralized).

- 3. The Crucial Question: Is Blockchain Economically Viable for a Specific Use Case?

- Comparison to Alternatives: For many applications, a traditional, centralized database (SQL, NoSQL) managed by a trusted entity is far cheaper, faster, more scalable, and easier to manage. The key economic question is whether the unique benefits of blockchain (trustlessness, transparency, immutability) outweigh its significant costs and complexities for that specific problem.

- Problem Fit: Blockchain makes the most economic sense when:

- Multiple, mutually distrusting parties need to share and agree on data.

- Immutability and auditability are paramount.

- Disintermediation offers significant cost savings or efficiency gains. A degree of decentralization is required for resilience or censorship resistance.

- Private/Permissioned vs. Public Blockchains:

- Public: Higher potential for true decentralization and censorship resistance, but often higher transaction costs (gas fees), lower throughput, and less control. Economic model often relies on native tokens.

- Private/Permissioned: Controlled by a single entity or consortium. Generally faster, cheaper transactions (no public gas fees), and higher privacy, but sacrifices decentralization and potentially some trust benefits. Costs are shared among participants or borne by the managing entity. Often closer to a shared, immutable database than a truly decentralized system.

- 4. Economic Reality Check:

- Hype vs. Reality: Many proposed blockchain use cases haven’t proven economically superior to existing solutions after the initial hype.

- Adoption: While adoption is growing in specific niches (DeFi, supply chain pilots, cross-border payments, NFTs), it’s far from mainstream for general database needs.

- Immutability as a Drawback: The inability to easily change or delete data can be an economic liability, especially concerning errors, updates, or regulations like GDPR’s “right to be forgotten.” Workarounds exist but add complexity and cost.

- In Conclusion:

- The economic reality of blockchain ledgers is that they are often more expensive, slower, and more complex than traditional databases. Their economic viability hinges entirely on whether the specific problem requires the unique benefits of decentralization, transparency, immutability, and trust reduction among multiple parties, and whether these benefits provide value that significantly outweighs the higher costs and inherent limitations compared to centralized alternatives. For many standard data storage and retrieval tasks, traditional databases remain the far more economical choice

Since 1984, when I was told I needed to carry this mobile phone with me, there has been that nagging issue of needing to make sure it had enough life to get me to the next charge point. My first phone was luck if it could last a half a day so they gave me two, one was always being charged while the other hung on my shoulder. In 1993 while working on the development of the EMV Specifications we focused on the ability to authorize a transaction when the Point of Sale POS device was unwilling or unable to reach the issuer. In 2013 I listened to Visa representatives explain how 100% of all payment transactions could be executed online. Then I ponder getting a

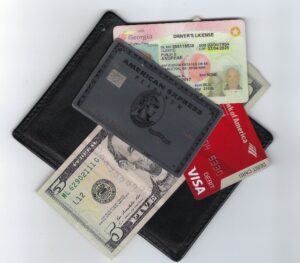

Since 1984, when I was told I needed to carry this mobile phone with me, there has been that nagging issue of needing to make sure it had enough life to get me to the next charge point. My first phone was luck if it could last a half a day so they gave me two, one was always being charged while the other hung on my shoulder. In 1993 while working on the development of the EMV Specifications we focused on the ability to authorize a transaction when the Point of Sale POS device was unwilling or unable to reach the issuer. In 2013 I listened to Visa representatives explain how 100% of all payment transactions could be executed online. Then I ponder getting a  The card remains the essential element of a successful payment transaction.

The card remains the essential element of a successful payment transaction.