I recently absorbed the following article and offer the following reflections.

Frankly, it disturbed my social consciousness.

http://paymentsjournal.com/there-are-an-estimated-how-many-million-smartphones-in-the-hands-of-us-consumers/

An article answering the question can now be found at this link.

http://paymentsjournal.com/could-a-us-cryptocurrency-prevent-systemic-harm-to-the-underbanked-and-underserved/

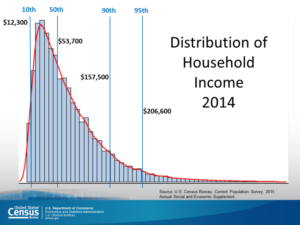

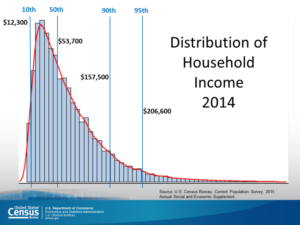

After reading the article, I thought about this graph derived from the US Census. What income level equates to that of the un-banked? I think of my expenses and about the expenses most people are dealing with. Health issuance for two people in Georgia is $1,100 a month. That’s a lot of people struggling to make sure they at least have health insurance! If $53,700 is the median income and $13 thousand is spent on health Insurance, and then we consider all the other daily expenses we need to live: food, medicine, co-pay, gas, utilities …

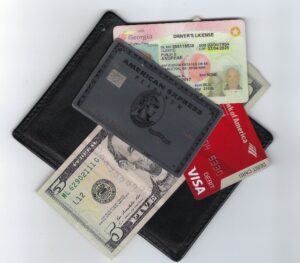

Then I remember an economics report which claimed that the hourly wage required to afford a place to live in the least expensive part of the US was something just over $15/hour. All of this causes me to ask the question – At what income do people find it of value to have a banking relationship, e.g. a card?

Those who argue that we should migrate from Cash to Card should remember the primary motivation for credit cards is directly related to the profits and revenue the banks, processors and other players who touch the flow of money earn from processing the payment transaction, and the revenues earned by lending money (i.e., a credit card) or by holding your money (a debit card).

Sure, we could propose giving the poor pre-paid cards, as some of the Government’s entitlement programs already do. But then who will be responsible for the fees to manage the program and who will earn the interchange from each transaction?

The service fees, OK, maybe we the taxpayer will cover, given the perceived social value of supporting the poor. On the other hand, entitlement is perceived by many to be a scheme to support the lazy, therefore many would say that the fees are part of what the entitlement should cover.

Let’s get back to the real subject at hand: What is the most economic form of payment and are crypto-currencies the future?

In the world of cards, interchange is a cost to the merchant and revenue to the Banks. Therefore, since merchants end up loading their processing costs into their price, the consumer pays. Those who advocate migration away from cash recognize and argue cash has costs, for intance:

- Cost of Employee pilferage

- Cost to store and carry to the bank

- Cost to handle and count

Many would agree that a card is cheaper. Others would argue they are not. This becomes a question of faith in your employees, the cost of a safe and a visit to the bank and the fun of sitting up at night counting your earnings.

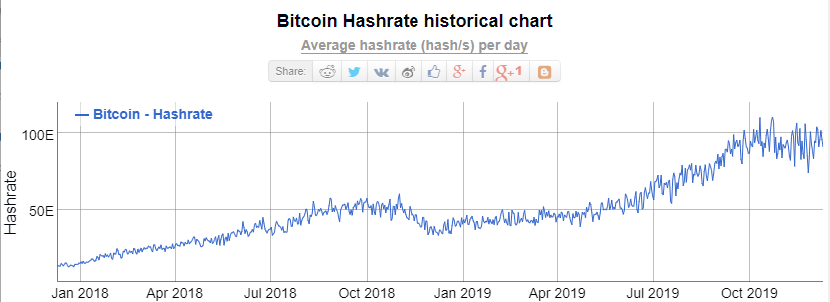

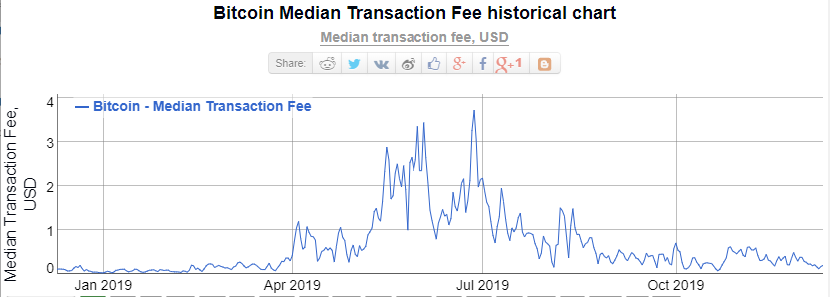

Are crypto-currencies an answer? At whose cost? The nodes or miners who maintain the Blockchain need to be paid to ensure the immutability and consensus inherent in the Bitcoin model. Someone must pay.

This begs the question: Which is more expensive to society?

- Cards

- Crypto-currencies

- Checks

- Cash

- Coins

- Certificates – in other words, tokens

A toll on the Massachusetts turnpike is $4.00, unless you can’t afford an EZPass then it will cost you $7.35*. This article published in Convenience, the web site of National Association of Convenience Stores (NACS), points out that restaurants are also increasingly eliminating cash and that the impact this has on the poor has finally started to create some pushback in D.C.:

“As more restaurants go cashless, a backlash is building, especially in the nation’s capital, where an increasing number of fast-casual eateries are only accepting credit or debit cards and mobile payments, the Washington Post reports. Sweetgreen, a national chain, doesn’t accept cash at most locations, including its Washington, D.C., unit, while Menchie’s, Barcelona Wine Bar, The Bruery, Jetties and Surfside in the District also refuse cash payments.

‘By denying the ability to use cash as a payment, businesses are effectively telling lower income and younger patrons that they are not welcome,’ said D.C. Council member David Grosso, who has introduced a bill that would require retailers to let customers pay in cash. Chicago didn’t pass a similar bill last year, and Massachusetts has a 1978 law on the books that’s for cash payments but it hasn’t been enforced regularly, according to the state retailers association.” (Emphasis by Payments Journal)

I was unaware of the 1978 Massachusetts law described here, but clearly MassDOT and the Massachusetts legislature are more interested in how it will spend the money saved and the new revenue generated than it is in old laws. The fact that the policy to go all electronic will also increase late payment fines from the poor, perhaps even putting some in jail for non-payment, is just icing on the cake.

In our rush to save money we have ignored the systemic biases this action creates against the poor (if you doubt this statement reread the Justice Department’s report on Ferguson Missouri and how the town’s cost cutting measures created that very same bias). My dollar bill states that “THIS NOTE IS LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE” and yet nobody is considering how this is becoming less true every day and the impact that reality will have and it isn’t just the poor.

It is ludicrous to think that paper currency can survive even as everything around us shifts to electronic bits that are controlled by software. But we mustn’t ignore the ramifications of this shift. Consider what the future would be like if all payments are electronic utilizing our existing payments infrastructure. It is likely the cost burden would move from the Federal government (that prints money) to all the entities that need to send or accept money (because they pay the network and processing fees). In this scenario a) the government will see significant savings, b) the entities making a payment will see increased costs, and c) payment networks will receive increased revenue and profits.

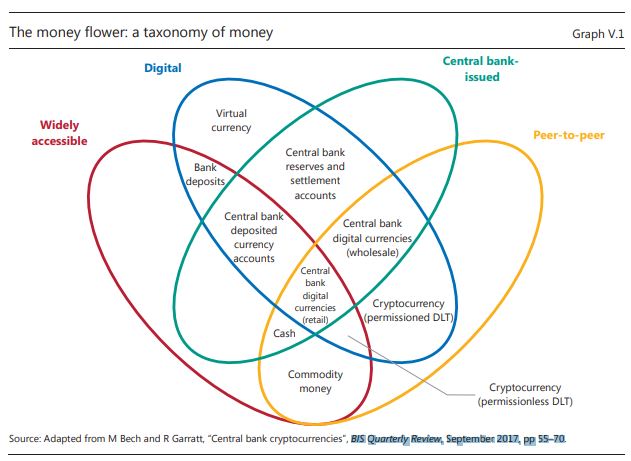

If we would prefer to keep the status quo then the Federal government should support an electronic form of tender, establishing a cryptocurrency that replaces paper but is also recognized as “LEGAL TENDER FOR ALL DEBTS, PUBLIC AND PRIVATE”.

If not done relatively soon, say in the next 5-8 years, then every state and private payment network will be so entrenched that it would likely prove too difficult and costly to switch.

* The difference described above is for anyone driving 113 miles between Natick and West Stockbridge according to MassDOT’s toll calculator