Mobile payments is being discussed in the context of “creating” a new “means of payment” or in other words a new “Payment Brand”. I would suggest the expense and time it takes to create a new “Payment Brand” is significant not to ignore expensive.

Just look at PayPal. How long, on the backs of eBay, did it take to reach the point where they are ready to enter into a venture with Verifone to become a “means of payment” their buyers can use at the real world stores of their sellers.

Two models for payments exist in the market today and frankly these two models have not changed, since the beginning of any form of commerce.

The three party model and the four party model.

Classically banks regulated and trusted to hold our moneys in accounts are fundamental to the act of payment. They have always been key to developing and operating the payment systems.

Unless of course we use cash.

In both models two parties always exist – the Buyer and the Seller, the Payer and the Payee or the consumer/cardholder and the merchant.

In the four party model we add two Banks who support one of these two parties. There is the bank with the relationship with the consumer/buyer/payer/cardholder, often called the Issuing Bank. On the other side of the payment there is the bank with the relationship with the merchant/seller/payee, often called the Acquiring Bank.

The three party model, simply means that the Bank of the payer and the Bank of payee are the same. The movements of funds flows from the buyers account to the sellers, as ledger entries, within a single institution.

American Express and PayPal are perfect examples of non-Banks who operate three party payment systems.

The central bank is another example of a three party system. All the banks within a country are clients of the central bank and have accounts at the central bank.

Clearly the three party model is the most efficient. But, it requires that there is a monopolist who processes payments for all buyers and sellers in order for the system to truly work. Reality dictates that a monopoly or agreement by all parties to use a single entity for their banking and payment services must exist for such a system to dominate the market.

Therefore, the payment systems have evolved cooperatively; based on acceptance by the consumer and merchant of a recognized means of payment. The banks work together to establish a set of rules and procedures they employ to transact payments. Various four party models i.e. MasterCard and Visa along with checks, electronic fund transfers, dominate the payments landscape.

Inherent to these models is a Brand (acceptance mark), a set of rules and a clearing mechanism. Everything works because there are agreed rules and procedures that govern how the two banks execute payments. To complete the cycle these two banks ultimatelyexchange real money, typically through a settlement bank or the central bank representing the total value of the payments processed.

To add complexity to the landscape, the Issuer and Acquirer often contract with processors to do the work. These to entities are identified in the graphic as the Issuing Processor and the Acquiring Processor.

Behind the term mobile payments, some think there is a more efficient method of affecting payments. They believe inserting a new player into the game will make the whole system more efficient and therefore cheaper. Or more appropriately they think that their new approach will allow them to earn a portion of the Merchant Discount (fee paid by the Merchant to the Acquirer) or the Interchange (fee paid by the Acquirer to the Issuer).

The more I think, read and discuss, the more convinced I become that creating a new payment Brand is an expensive exercise and frankly believing we can create something new and more efficient than the existing four party models is irrational.

So what does the Mobile Phone bring to the payment landscape?

Clearly ISIS understands. Mr Abbott states “We plan to create a mobile wallet that ultimately eliminates the need for consumers to carry cash, credit and debit cards, reward cards, coupons, tickets and transit passes.” Key word “WALLET” by definition “A wallet is a small, flat case used to carry personal items such as cash, credit cards and identification documents, such as a driver’s license. “ Interesting, a mobile phone is a small, flat object that can carry a digital facsimile of cash, cards, identifications documents … .

Next we think about NFC “Near Field Communications”, a method of transferring data between the content of the Wallet to the merchant’s Point Of Sale device “POS”. Tap instead of swipe. NFC replaces the read of the magnetic stripe with the transfer of the data from the Mobile Wallet to the merchant’s POS. To achieve this goal PayPass and the otehr contactless payment cards simply stores what is on the magnetic stripe and passes it via NFC to the POS. Given that a mobile phone is a computer we can introduce digital certificates and do it much more securely.

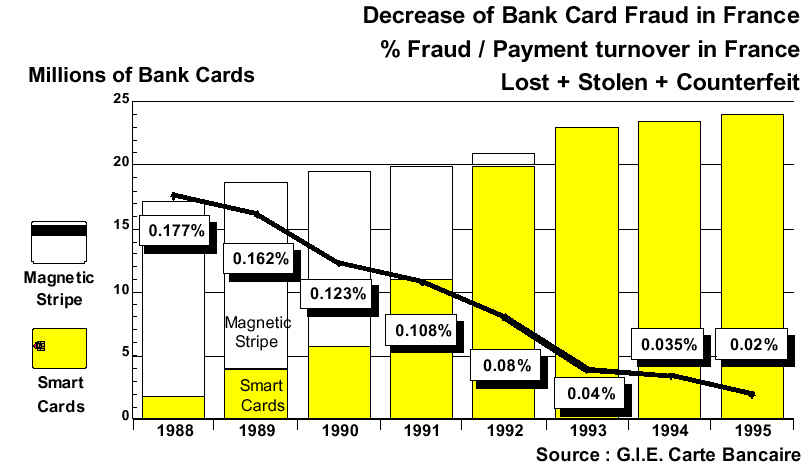

This is exactly what EMV Europay, MasterCard and Visa defined and employ. Debit and credit card issuer throughout the world are now employing the trusted characteristics of a chip card to secure their credit and debit card payments using digital certificates.

With a Mobile Wallet (remember the SIM is a chip card) a trusted component is available, inside the consumer’s wallet, capable of supporting EMV and assuring the authenticity of the content (Card) of the wallet and the identity of the owner of the wallet.

Bob Egan in a recent Forbes article The ISIS Mobile Wallet: Are Visa, MasterCard and PayPal Under Siege? writes “To me it’s quite clear the ISIS is taking matters into its own hands. I predict we will see ISIS become the issuer behind new carrier partner plastic credit/debit and prepaid cards in addition to mobile wallet capabilities for those cards become resident as applications on mobile phones.” This suggests that Isis is going to compete with Barclaycard. If this is the case then what does the following statement in the Isis release mean “Barclaycard US, part of Barclays PLC, is expected to be the first issuer on the network, offering multiple mobile payment products to meet the needs of every customer. “

So what is Isis planning? Clearly Pundits are not sure.