As I sat to write, I was drawn to the Wikipedia’ Bitcoin article. As I read the story of how it all happened memories and concerns once again flowed through the neurons of my mind. Silk Road and their involvement and the evolution of the value of a Bitcoin, struck me as a magical mystery tour through a world of mathematicians, anarchists, profiteers and speculators.

I then remember reading

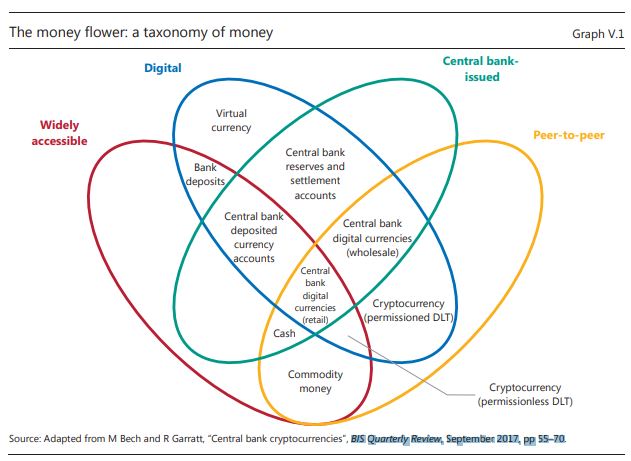

an element of a report from the Bank of International Settlement on crypto currency. The picture above is intriguing for those of us who appreciate the complexity of payments. The article gets ever so intriguing when one continues to read and finds this interesting illustration of

the difference between what we all are familiar with and what those who understand DLT and Bitcoin appreciate. The central focus of this new technology is to address one and only one concern. Trust in the intermediary.

I must admit this particular article is not the one I originally intended to speak to. I do though recommend reading it.

The article I had intended to reflect on is Central Bank Cryptocurrencies. In this document they speak to the possibility of the banks issuing a stablecoin. The recent announcement of JPMorgan Chase is one example of such.

This then causes me to reflect on the various use cases and conversations with people about the potential of DLT. I wonder why, at least here in the USA with our judicial and regulatory framework and the rule of law; we would seek to replace the existing intermediaries with a permissionless distributed ledger and the associated consensus mechanisms of a public ledger. There is enormous and growing cost in consensus built on “Proof of Work” and massive duplication of the ledger or as most call it the chain. Be it the electrical cost, the cost of a data center or the specialized computers necessary. The people and companies, the nodes and miners, will expect a reward for their effort.

Which is cheaper, if a reasonable level of trust exists?

Where are we going from here

This is the question. There are those that believe Block-chain and all of the other distributed ledger technologies are the answer to everything. I would suggest one much consider:

-

- The level of trust the various parties have in each other.

- The cost of multiple copies of the distributed ledger.

- The cost of the consensus mechanism versus a trusted intermediary.

- The governance required to maintain security, software and specifications.

- The value and ethical issues of anonymity.

This then begs the question of a permissioned or a permissionless ledger. Which then begs the question of governance and who is responsible to establish the rules.

It is clear there is value in the idea of a distributed ledger. I would suggest caution in deciding if it makes sense for your use case.

-

-

- What are the goals and objectives of the solution?

- What are the economics of the various approaches?

- Who are the stakeholders?

- Who determines the rules and manages change?

- Can the participants trust an intermediary?

- Does everyone fear what another could do?

-

Helping you to understand the answers to these questions is what we do.